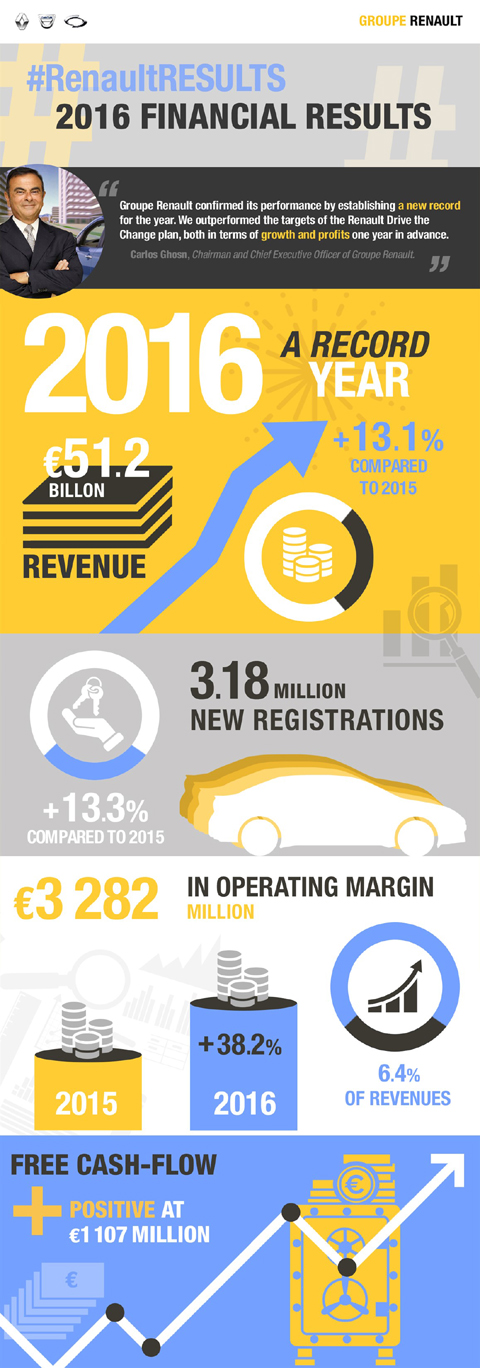

"After very strong results in the first half of the year, Groupe Renault confirmed its performance by establishing a new record for the year. We outperformed the targets of the "Drive the Change" plan, launched in 2011, both in terms of growth and profits one year in advance. This success rewards the hard work of all Group employees." said Carlos Ghosn, Chairman and Chief Executive Officer of Renault.

In 2016, under the impetus of the Drive the Change plan, Groupe Renault reached a new sales record and becomes the number-one French automotive group worldwide, with 3.18 million vehicles registered. Volume and market shares were up in all regions.

In 2016, Group revenues were €51,243 million, up 13.1% from 2015. This represents growth of 17.0% at constant exchange rates.

Automotive revenues were €48,995 million, up 13.7% thanks to an increase in the Group’s brand volumes and sales to partners. The price effect was positive, due to the impact of new models and price increases in some emerging markets to offset currency devaluations.

The Group operating margin was €3,282 million (+38.2%), compared to €2,375 million1 in 2015, representing 6.4% of revenues (5.2%1 in 2015).

The Automotive operating margin was up €840 million (+54.3%) to €2,386 million, or 4.9% of revenues (versus 3.6%1 in 2015).

This performance is mainly explained by volume growth (€1,036 million).

Continuing efforts to reduce costs positively contributed for €184 million, taking into account a significant increase in R&D expenses.

The mix/price/enrichment effect was positive at €115 million, in particular due to the impact of our new models and price increases in some emerging countries.

The currency impact was highly negative at -€702 million, reflecting firstly the depreciation of the British pound and the Argentinean peso.

Raw materials continued to have a very favourable effect of €331 million.

The company's G&A increased by €112 million.

Sales Financing contributed €896 million to the Group operating margin, compared with €829 million1 in 2015, an increase of 8.1%.

Cost of risk (including country risk) has stabilized at a very good level of 0.31% of average performing assets (versus 0.33% at end-2015).

Other operatingincome and expenses are near-neutral at €1 million. This balance is primarily due to a profit of €325 million recorded following the first full consolidation of AVTOVAZ at December 31, 2016, and to provisions for restructuring, in particular in France, for a total amount of €283 million. No provision has been booked regarding the diesel investigation in France.

Accordingly, the Group operating income came to €3,283 million, compared to €2,1761 million in 2015.

Net financial income and expenses is a charge of €323 million, compared to -€221 million in 2015. This evolution came mostly from lower financial income notably in Argentina, and foreign exchange gains in 2015.

The contribution of associated companies came to €1,638 million, compared to €1,371 million in 2015.

Nissan’s contribution amounted to €1,741 million in 2016, versus €1,976 million in 2015.

AVTOVAZ’s contribution for 2016 was negative at -€89 million, versus a loss of €620 million recorded in 2015.

This improvement stems mainly from a sharp reduction in impairment losses recorded in 2016 compared with 2015, and partly, from the company's improved operating performance. Furthermore, accounting for AVTOVAZ’s losses in the results of equity affiliates was capped in 2016 at the value of the investment in Renault’s books.

Net income came to €3,543 million (+19.7%) and net income, Group share, to €3,419 million (€12.57 per share, compared with €10.35 per share in 2015, up 21.4%).

Positive Automotive operational free cash flow came to €1,107 million, after taking into account a positive change in working capital requirements of €356 million over the period.

The net cash position, after AVTOVAZ consolidation, amounted to €2,720 million (€3,925 million before the consolidation).A dividend of €3.15 per share, versus €2.40 last year, will be submitted for approval at the next Shareholders' Annual General Meeting.

AVTOVAZ

As the first full AVTOVAZ’s consolidation occurred on the 28th of December 2016, the income statement was not consolidated. On the other hand, the company's balance sheet was consolidated in our financial statements. The consolidation impact on Groupe Renault’s net financial position was a negative €1,205 million, and a preliminary goodwill of €1,025 million was accounted for. As of 31st of December 2016, AVTOVAZ market value was higher than the carrying value of AVTOVAZ net assets including goodwill in Renault’s financials.

During 2017, some other capital restructurings are contemplated in order to restore AVTOVAZ’s equity.

AVTOVAZ’s management communicated its detailed recovery plan on January 16th 2017.The main objectives of this plan is to reach positive operating profit (before impairment and restructuring costs) in 2018 and achieve profitable growth beyond. This presentation is available on our website:

https://group.renault.com/en/finance-2/financial-information/documents-and-presentations/

OUTLOOK 2017

In 2017, the global market is expected to record growth of 1.5% to 2%. The European and French markets are expected to increase by 2%.

At the International level, the Brazilian and Russian markets are expected to be stable. On the other hand, China (+5%) and India (+8%) should continue their momentum.

Within this context, and including AVTOVAZ, Groupe Renault is aiming to:

- increase group revenues, beyond the impact of AVTOVAZ (at constant exchange rates)*,

- increase group operating profit in euros*,

- generate a positive automotive operational free cash flow.

(*) compared with 2016 Groupe Renault published results

MIDTERM PLAN 2022

Groupe Renault will present in 2017 a new strategic plan 2017-2022, with an ambition to reach €70 billion (at constant exchange rates) in revenues and 7% operating margin at the end of the plan, while maintaining a positive operational automotive free cash flow every year.

RENAULT CONSOLIDATED RESULTS

| € million | 2016 | 2015(1) | Change |

| Group revenues | 51,243 | 45,327 | +5,916 |

| Operating profit | 3,282 | 2,375 | +907 |

| % of revenues | 6.4% | 5.2% | +1.2pts |

| Other operating income and expenses items | 1 | -199 | +200 |

| Operating income | 3,283 | 2,176 | +1,107 |

| Net financial income | -323 | -221 | -102 |

| Contribution from associated companies | 1,638 | 1,371 | +267 |

| o/w : NISSAN | 1,741 | 1,976 | -235 |

| AVTOVAZ | -89 | -620 | +531 |

| Current and deferred taxes | -1,055 | -366 | -689 |

| Net income | 3,543 | 2,960 | +583 |

| Net income, Group share | 3,419 | 2,823 | +596 |

| Automotive operational free cash flow | 1,107 | 1,051 | +56 |

(1)Taxes, which satisfy the definition of tax based on a taxable profit according to IAS 12 "Income Tax" and which were previously presented as operating expenses, have been reclassified under current taxes from 2016 and conversely for taxes not satisfying the definition of tax based on a taxable profit income. The presentation of the financial statements for the year 2015 was restated accordingly.

ADDITIONAL INFORMATION

The consolidated financial statements of Groupe Renault at December 31, 2016 were approved by the Board of Directors on February 9, 2017.The Group’s statutory auditors have conducted an audit of these financial statements and their report will be issued shortly.The earnings report, with a complete analysis of the financial results in 2016, is available at www.groupe.renault.com/en/ in the Finance section.